Is Russia firing up the money printing press?

Hello! This is Alexandra Prokopenko with your weekly guide to the Russian economy — brought to you by The Bell. In today’s newsletter, we’ll look in depth at whether Russia really is printing money to cover its growing budget deficit.

Inflation risks as Russia grapples with budget deficit

Russia last year saw a budget deficit of 3.3 trillion rubles ($43.6 billion), or 2.3% of GDP. This year, the Finance Ministry is planning for a deficit of 2% of GDP (2.9 trillion rubles) — but economists are doubtful that it can be achieved. Instead, they predict the deficit will come in at somewhere between 3.1 trillion and 6.9 trillion rubles.

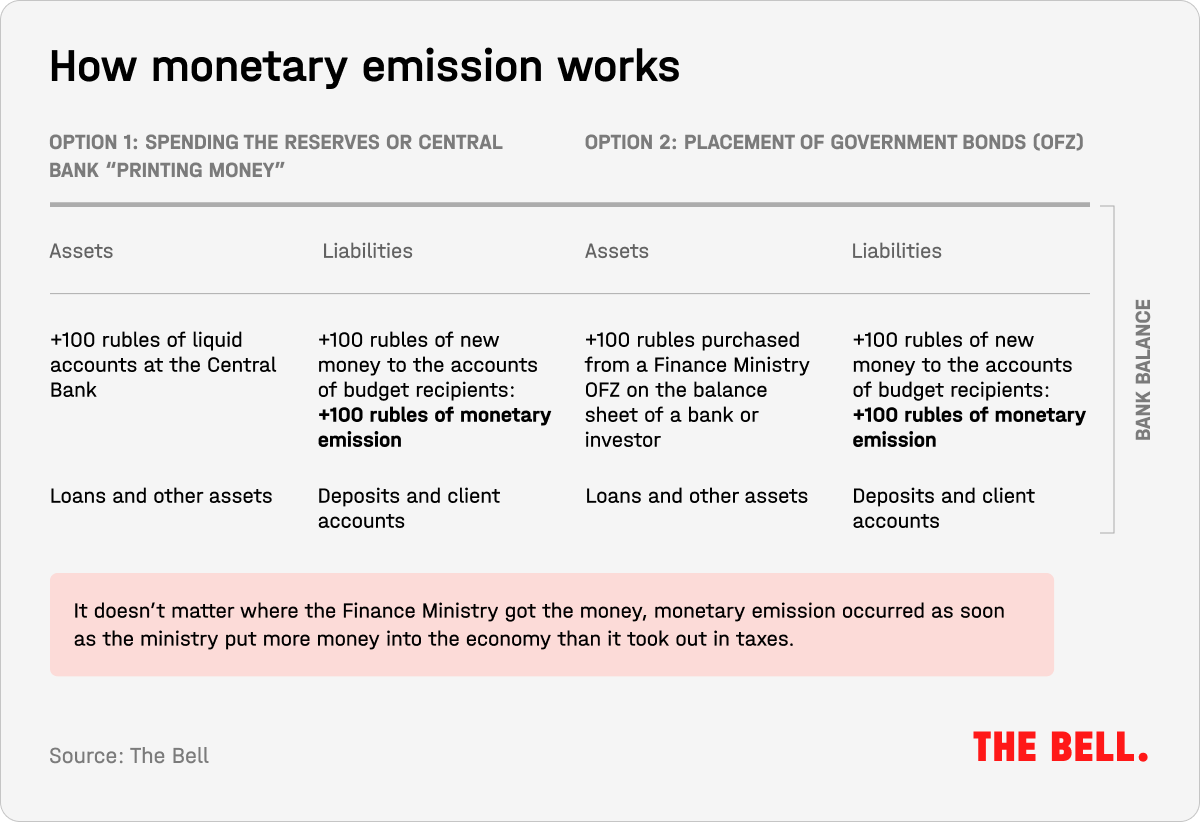

The authorities will close that hole by borrowing on the domestic market. The Finance Ministry is already issuing bonds, which are redeemed by the banks using money from the Central Bank. This looks a bit like new money and some economists suspect the Central Bank of printing money. We explain whether this is really happening — and the risks.

What’s the Finance Ministry doing?

Last year’s budget deficit was only slightly less than at the peak of the pandemic in 2020 (4.1 trillion rubles). But, back then, the budget immediately bounced back to a surplus. In the first months of 2023, however, there was little scope for optimism: in January alone, the deficit hit 1.76 trillion rubles. According to Bloomberg’s Alexander Isakov, this year’s deficit could be as big as 6.9 trillion. Discussions are already well underway about how to plug that hole.

Russia last year covered the deficit by selling foreign currency from the National Wealth Fund (NWF) and issuing more OFZ government bonds.

- The Finance Ministry placed 3.1 trillion rubles’ worth of bonds last year. Almost half — 1.44 trillion rubles — were issued in December. The main purchasers of these OFZs were big banks, particularly state-owned ones. Before the war, government bonds were also in demand among non-residents (in 2020, 35% of OFZs were sold to foreign investors) — but now they no longer have any presence in this market.

- Finance Minister Anton Siluanov has said about 2 trillion rubles were sold from the NWF. In previous years, transactions with the NWF were mirrored by currency operations on the domestic market: if the ministry sold currency from the fund, the Central Bank purchased an equivalent amount (meaning the overall macroeconomic impact was neutral). Since part of its reserves were frozen last year, the Central Bank could no longer mirror the ministry’s operations in dollars and euros. But the authorities returned to mirroring in January 2023 after implementing the new version of the budget rule.

Both domestic borrowing and NWF expenditure represent an increase in the money supply. That poses inflation risks, according to analysts from SberCIB. The Central Bank has said that the M2 money supply total (the sum of cash in circulation plus what is held on accounts) last year increased 24%. This literally means there is more money in the economy.

In its recent publication, Deutsche Bank analysts described this as “printing money.” And, at the end of last month, rating agency Moody’s wrote in its Russia forecast that it feared the government would have to adopt “unorthodox methods,” including “monetary financing” of the budget deficit — in other words, printing new money.

But is this really the case? Yes and no. While the amount of money in the economy is increasing due to decisions by the Finance Ministry and the Central Bank, the “printing press” has not been switched on. To understand what’s happening, it’s important to remember the nuances of Russia’s monetary system — and modern monetary systems in general.

How does monetary system work?

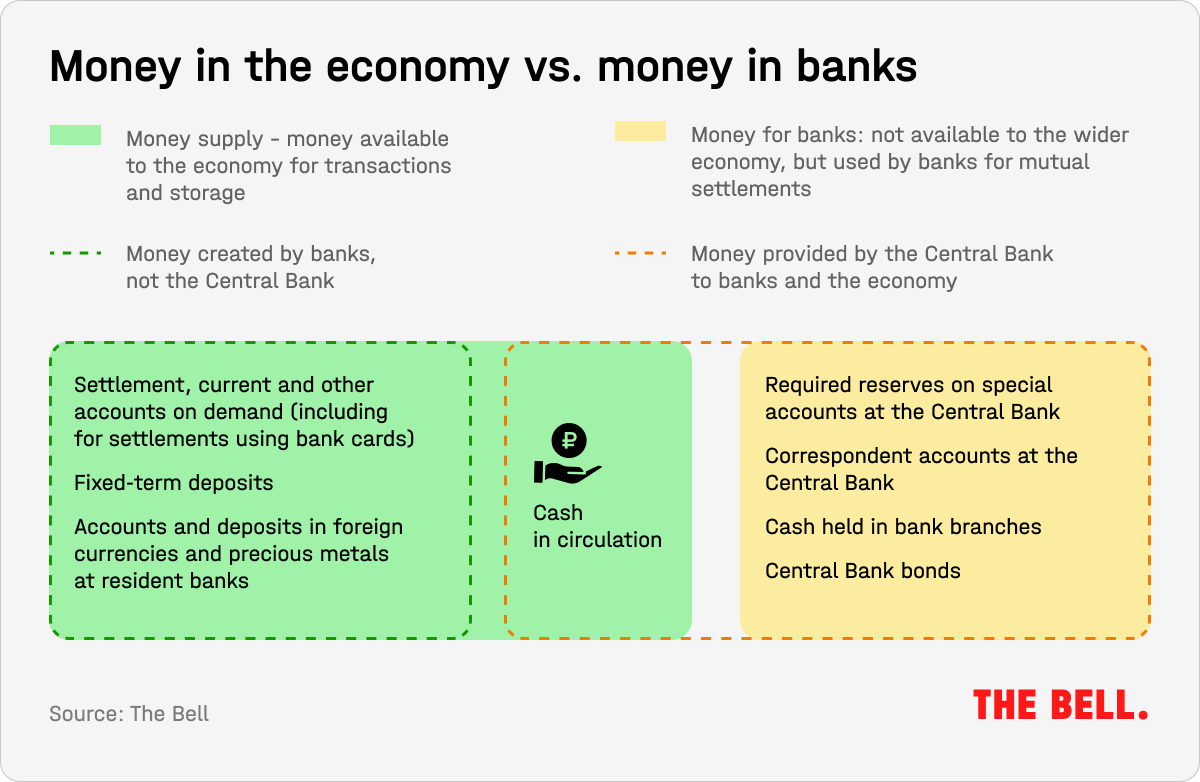

In modern monetary systems, there are two types of money:

- Central Bank money, which is also the money in the financial sector. This is the cash in the correspondent accounts of banks held at the Central Bank — in effect the Central Bank’s obligations towards the entire banking system. This never enters the wider economy and exists exclusively between the Central Bank and those banks to which it extends credit. You can read more about this system here.

- Money in the real economy. This is created when banks make loans or acquire assets. It is also created by the government when it spends more than it collects in taxes. The simplest example is the issuance of a loan by a bank.

An increase in the Central Bank’s money supply does not necessarily lead to inflation. For example, when the Central Bank redeems state debt (how quantitative easing works) it simply replaces government debt (long duration) with Central Bank debt (short duration). All transactions take place using funds from the financial sector and the real economy is unaffected.

However, increasing the money supply in the real economy is a factor in inflation. In our case, the government creates new money supply by allowing the budget deficit to grow and thereby influencing banking liabilities. Meanwhile, the Central Bank has no mechanism to control government spending — nor the rate at which it borrows.

Money received from the Central Bank when state-owned banks purchased OFZs is essentially just a substitute for budget funds. This becomes a liability for the bank, which is replaced and returned to the Central Bank when budget expenditures are made.

However, one way or another, monetary emission is already happening. It started as soon as the government decided to increase spending beyond what it receives in revenue. Does this mean inflation in the real economy is destined to accelerate? Not necessarily — as long as the government borrows at market rates and the Central Bank keeps those rates high.

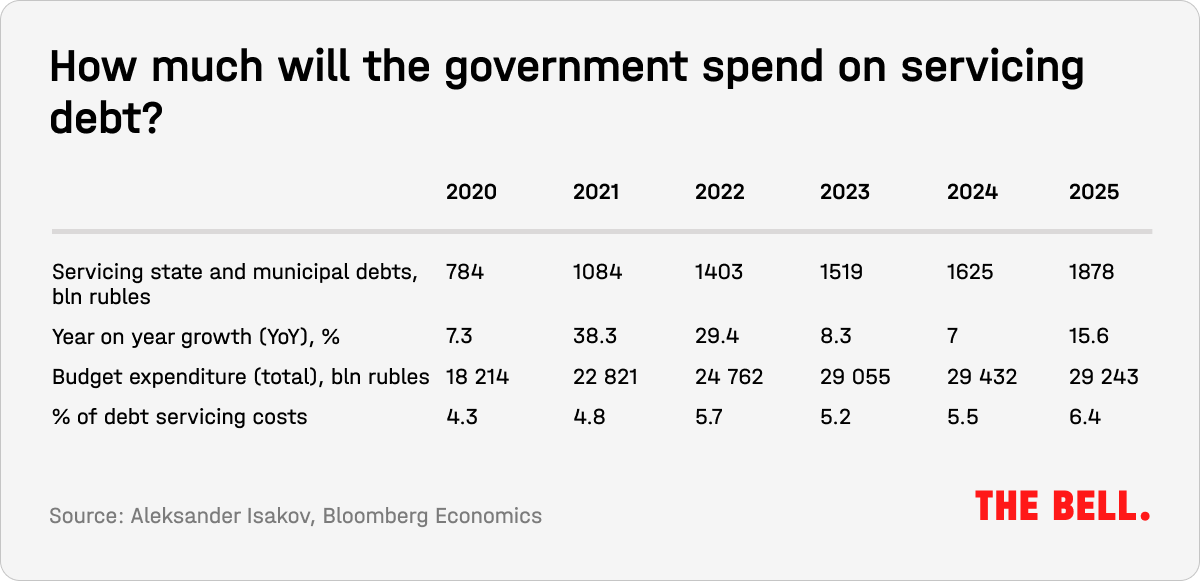

- The government’s debt-servicing costs depend on interest rates. Four fifths of the Russian domestic public debt (about 15 trillion rubles) are liabilities at floating rates linked in some way to the Central Bank base rate. These include OFZs with floating coupons, preferential mortgages and preferential corporate loans under government programs. This means each rate increase has an impact.

- While the Central Bank’s rate remains relatively high, it limits the flow of credit from banks into the real economy. Remember, that there is a direct link between rising state expenditure and increased interest rates.

At present, there is no expectation of monetary policy easing: at its last meeting, Russia’s Central Bank held the rate at 7.5%. The bank’s prognosis for inflation in 2023 is between 5% and 7%, despite the fact that, by spring, price growth is expected to drop below 4%.

Why the world should care

Traditional notions of “printing money” are largely outdated. In modern economics, central banks only create money within the financial sector. Meanwhile, money in the real economy is created by banks via credit — and by the government via a budget deficit. If the Russian economy was really making a steady recovery, the government wouldn’t have to increase the budget deficit so rapidly. Monetary emission in a modern economy also indicates that a central bank has lost its independence. Russia’s Central Bank has not reached that stage. But, this year, the rapidly expanding budget deficit means it will be much harder for the Central Bank to continue fighting inflation: revenues are not keeping pace (and under Western sanctions, they cannot keep up) with expenses driven by the war in Ukraine.

Pollsters argue over how many Russians support the Ukraine war

Since the Russian invasion of Ukraine, sociologists have grappled with the question of how many Russians support the Russian army in Ukraine. Both independent and state-run pollsters claim they are the majority, and these studies are frequently referenced in Western media. However, at the same time, a group of independent sociologists have pointed out that these polls may not be representative — many Russians are reluctant to speak freely about their thoughts on the conflict due to draconian wartime censorship laws.

- Independent researchers from the Khroniki project recently presented the findings from their latest survey, which suggest using a percentage of how many Russians support the war may not be a very meaningful statistic. In their view, this figure comprises a misleadingly wide spectrum of people: from those who volunteered to fight in Ukraine to those afraid of repression. Moreover, at least half of those who are opposed to the war are afraid to speak out, the Khroniki sociologists said.

- To identify the core pro- and anti-war groups in Russia, the pollsters devised a series of questions. The results of their survey suggests that the core support group represents 22% of the population, while the core opposition is 20.1%.

- Separately, researchers stress that “the fridge counters the effects of the TV,” and this effect is felt more and more with each passing month. The level of support for the war among TV viewers who are encountering economic pressures is falling. Among TV viewers who have encountered at least one economic problem, support for the war was down 11 percentage points in February.

- Other polls, however, show that a vast majority of Russians support the war. For example, according to state-run pollster VTsIOM, 68% of Russian residents welcomed the invasion of Ukraine and just 20% are opposed to it. And leading independent polling agency Levada Center published results in January that suggested 75% of Russians support the war — to varying degrees.

Why the world should care:

It’s not easy to work out exactly what proportion of the Russian population supports the war, but Khroniki is certain that the pro-war lobby is far smaller than polls from leading agencies would suggest. If that is true, it casts doubt on the widely-held belief in the west that the war in Ukraine is supported by most Russians who remain inside the country.

Figures of the week

- The average price for Russia’s Urals crude in January and February was $49.5 per barrel, according to the Finance Ministry. In February, Urals cost $49.6 a barrel, close to half its price in Feb. 2022 when it was trading at $92.2.

- There was atypical deflation in late February. From Feb. 21 to Feb. 27, prices fell 0.02%, according to the State Statistics Service. The main driver of this deflation was a fall in prices for fruit and veg (-0.8%). The price of cucumbers fell faster than anything else, dropping 7.6%. Annual inflation slowed from 11.36% to 11.01%. However, except for volatile items (particularly food), a deflation trend is not visible, according to the Solid Figures Telegram channel.

- Inflationary expectations among the population are rising. The median inflationary expectation for the coming year reached 12.2% compared with 11.6% a month earlier. Long-term inflation expectations also remain rather higher than the Central Bank target: the median over the next five years is 9.3%.

- The Ministry of Finance estimated the shortfall of oil and gas revenues in March at Rb 132.1bn, while in February, it collected Rb 12.3bn more than expected. Therefore, it will allocate 119.8 bln rubles, or 5.4 bln rubles/day (~US$0.07 bln), for sale in currencies from March 7 to April 6.

What to watch for next week

- Central Bank bulletin “What the trends say” (March 7)

- Central Bank bulletin “Regional economy” (March 9)

- Central Bank macroeconomic survey (March 9)

- Assessment of the balance of payments for January and February (March 10)

- Monthly inflation (March 10)

- Preliminary assessment of the execution of the federal budget in January and February

- Outcome of placement of funds in the National Welfare Fund

Further reading

- Inside China’s Peace Plan for Ukraine Alexander Gabuev believes that China’s peace plan is not actually aimed at ending the war, but at impressing the developing world

- ‘Russia ends nowhere,’ they say Sociologist Grigory Yudin discusses a year of war and what comes next

- The Power of Bad News: How Mass Media Influences Inflation Expectations Alina Evstigneeva investigates the relationship between bad news and high inflation expectations

- How the war has changed Russia Nigel Gould-Davies examines what’s going on in Russia

The author of this newsletter is one of Russia’s leading writers on this topic: independent economic analyst Alexandra Prokopenko. Alexandra worked as an advisor at Russia’s Central Bank and Moscow’s Higher School of Economics from 2017 to 2022 — and before that she was an economic journalist for Vedomosti, then Russia’s leading business newspaper. Today, Alexandra is a columnist at the Carnegie Endowment for International Peace, and a visiting Fellow at the Center for Order and Governance in Eastern Europe, Russia, and Central Asia at the German Council on Foreign Relations. She holds an MA in Sociology from the University of Manchester.

Wrtten by Alexandra Prokopenko

Translated by Andy Potts