IMF predicts Russian economy to rebound in 2023

International economic institutions, which recently doubted Russia’s economy could survive under Western sanctions, are now sounding more optimistic than even the Russian government. The International Monetary Fund (IMF), known for its gloomy forecasts, this week predicted Russia’s GDP will grow at 0.3% this year.

The typically conservative IMF was much more upbeat than usual in its most recent forecasts for the global economy — for which it anticipates 2.9% growth (up 0.2 percentage points from its October forecast) because of “unexpectedly stable” dynamics.

Russia’s forecast was upgraded even more than the global figures: in October, the IMF expected a 2.3% fall in Russian GDP in 2023, now it is talking about 0.3% growth. In 2024, they believe Russia’s GDP will increase by as much as 2.1%.

IMF economists explain this surge of optimism with a familiar narrative: the stability of Russian oil exports. “At the current oil price cap level, Russian crude oil export volumes are not expected to be significantly affected, with Russian trade continuing to be redirected from sanctioning to non-sanctioning countries,” the report stated.

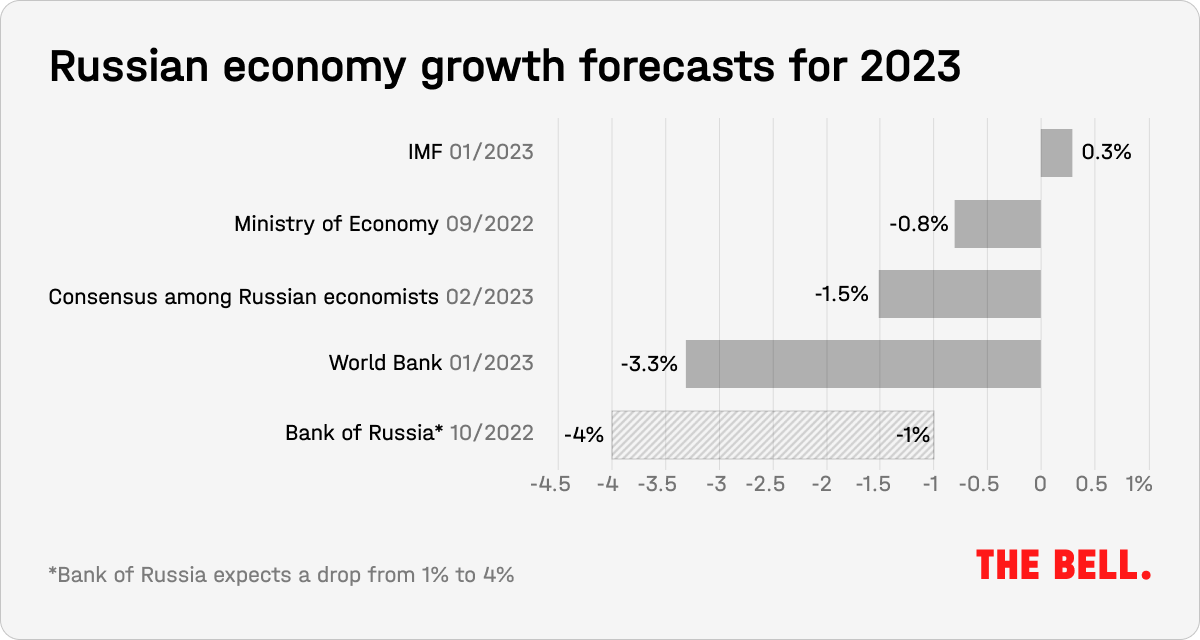

The IMF’s latest figures are the most optimistic forecast around. They are well above the February consensus among Russian economists (decline of 1.5% in 2023) and the official projections of the Russian authorities: the Ministry of Economic Development currently predicts a fall of 0.8% in 2023, while the Central Bank expects a drop of up to 4%.

If Russia’s economy is to live up to the IMF’s expectations, output needs to increase by 0.4% every quarter from the fourth quarter of last year to the fourth quarter of 2023, according to a Telegram channel run by Bloomberg Economics’ Alexander Isakov. The economist thinks this is realistic. “The shocks of losing the European gas market, the departure of car manufacturers and others remain… while retail lending is accelerating to finance a recovery in consumer demand,” Isakov wrote. “Thus, the IMF’s figures seem persuasive.”

What else does the IMF predict for 2023?

The forecast for China was upgraded from 4.4% to 5.2% and the projection for the U.S. goes from 1% to 1.4%. Germany is expected to avoid a recession and grow by 0.1%. Britain is alone among the world’s leading economies in that it is expected to finish the year with a drop in GDP — of 0.6%. That prediction prompted a wave of domestic criticism of the U.K. government, particularly from the opposition Labour Party.

“Economic growth proved surprisingly resilient in the third quarter of last year, with strong labor markets, robust household consumption and business investment, and better-than-expected adaptation to the energy crisis in Europe,” noted IMF chief economist Pierre-Olivier Gourinchas.

Other reasons for optimism are China’s unexpected post-Covid reopening and the return of a stable growth trajectory among developing countries (half the world’s global economic growth is set to be delivered by China and India).

Russia’s economy has adapted quicker than expected after the shocks of 2022. Central Bank analysts see five underlying reasons for this:

- The stability of the banking system. Thanks to ample capital reserves, banks have remained in reasonable shape — while lending was supported by regulatory easing;

- Falling export volumes offset by rising prices;

- Rapid redirection of exports toward Asia;

- An effective reshaping of logistics chains by import-based businesses;

- Government support.

Business activity in Russia continues to recover. According to an updated State Statistics Service (Rosstat) estimate and the Central Bank’s figures, in the third quarter the economy turned a corner (+0.86% compared with the previous quarter). Russia’s economy moves into 2023 with a higher level of activity than was expected in the spring, Central Bank analysts wrote last month. Demand has been underpinned by government spending.

However, it’s important to point out that the economic recovery is patchy.

Constraining factors include a growing preference for saving rather than spending among the general population, difficulties with maintaining imported equipment and staff shortages.

In November, almost half of Russian businesses (45%) reported staffing problems. The dwindling workforce and the significant wartime brain drain could result in fierce competition to hire the remaining talent. And that will likely push up salaries faster than productivity can match, bringing inflationary risks (The Bell recently spoke at length with Vladimir Gimpelson, director of the Center for Labor Studies at the Higher School of Economics about current trends on the labor market).

“The IMF scenario is clearly the most optimistic of the possible outcomes that have some chance of happening in 2023,” said Dmitry Polevoi, investment director at Loko-Invest.

“However, from our point of view, GDP will still fall by 1.5-2.5% in 2023 due to weak demand at home and abroad, coupled with high levels of uncertainty.”

Why the world should care

The IMF figures are plausible if Russia’s economy does not suffer any more major shocks in 2023 — for example, a sharp fall in energy prices or a major geo-political defeat. The IMF updates its predictions several times a year and, as new data emerges, further corrections will likely follow. There remains a lot of uncertainty.